What is ReadyCash by Bank Alfalah?

ReadyCash by Bank Alfalah is a small ticket sized loan product with a short tenor which will be offered to existing JazzCash wallet accountholders. Eligible customers can get a loan ranging from PKR 500 to PKR 30,000. The maximum tenor of this loan is 8-weeks. The loan amount, however, is subjective and range can vary over time based on customer’s DBR and repayment behavior

Who is eligible for ReadyCash by Bank Alfalah?

Only existing JazzCash Mobile Account holders are eligible for ReadyCash by Bank Alfalah. Eligibility is calculated based on customer’s Mobile Account and JazzCash App usage and credit scoring. The following criteria are considered:

- Salaried individual or self-employed

- Regular user of JazzCash app

- Sufficient balance maintained in JazzCash Mobile Wallet Account

- Frequent transactions via JazzCash

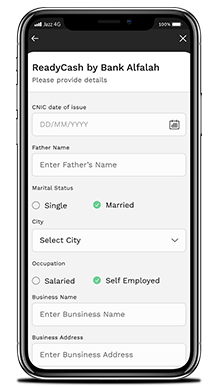

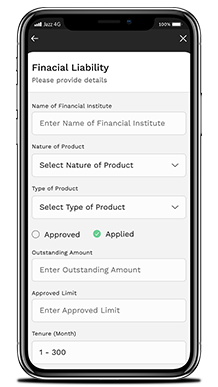

How to avail ReadyCash by Bank Alfalah facility?

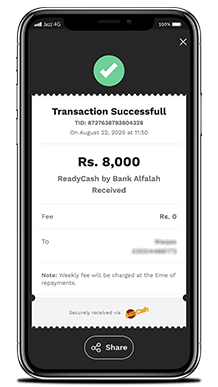

Existing JazzCash wallet-holders can avail ReadyCash by Bank Alfalah by logging into their JazzCash App, clicking on “ReadyCash by Bank Alfalah” in the “Banking and Finance” section and filling in their details. Once the details are submitted, the loan if approved, will be disbursed into your wallet account within 24 hours.

Navigation: JazzCash App > Banking & Finance > Login > Add Money > ReadyCash by Bank Alfalah

What is the minimum and maximum amount of loan that can be availed through ReadyCash by Bank Alfalah?

Loan amount ranging from PKR 500-30,000 can be availed, depending upon customer’s eligibility. The eligible limit can be increased through a good repayment behavior in previous loan cycle and by increasing wallet account balance and JazzCash App usage.

Can one person avail multiple loans at a single time?

No, only one loan can be availed at any given time. However, another loan can be availed after complete repayment of the existing loan.

How can one increase their ReadyCash by Bank Alfalah loan limit?

- Timely repayment of earlier loans

- Increase average balance in their JazzCash wallets

- Frequent transactions through JazzCash Wallet and Jazz Cash App

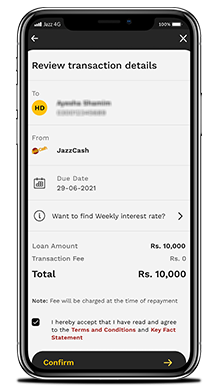

What are the charges for availing ReadyCash by Bank Alfalah?

ReadyCash by Bank Alfalah is a markup free loan product. Customers will only have to pay a processing fee with each repayment. The processing fee keeps increasing on a week on week basis. Starting from 8% during week 1 and going up to a maximum of 25% in the 8th week.

How can I view the transactions I have performed using ReadyCash by Bank Alfalah?

All transactions performed can be viewed in the Transaction History section of the JazzCash App.

What is the repayment structure?

Customer can repay the loan at any time during their 8 week loan cycle. After the 8th week however, Bank has the authority to auto-debit the outstanding amount from customer’s wallet account.

How can I repay the loan?

Customer can repay the loan at any time during their 8 week loan cycle by logging into the JazzCash App and going to the ReadyCash by Bank Alfalah menu. Loan can also be repaid by transferring money into the 16 digit loan account number shared with the customer through SMS and email at the time of loan disbursement.

Can I repay the loan partially?

During the 8 weeks period, loan can be repaid partially or in full amount at any time, as per customer discretion.

What happens if I fail to repay my loan within the Due Date?

If the customer does not repay their loan within 8 weeks, Bank Alfalah will have the authority to deduct the outstanding amount from

customer’s Mobile Wallet Account. In case of insufficient balance, the customer will have a grace period of 30 days to repay the loan, after which the credit rating of the debtor will take a negative hit and will be reported to the Credit Bureaus. This negative credit history will persist in the Credit Bureau record for a minimum of 2 years. Customer will also become ineligible for further availing this product.

Are any repayment extensions allowed?

No extensions will be allowed after 8 weeks.

Can I cancel the loan?

This is a one-time loan, once availed customer can fully repay the loan along with all applicable fees at any time to fulfil their obligation.

How can I get an NOC against this facility?

Customer can get a digital NOC against their last fully repaid loan, at any time, by logging into the JazzCash App and going to the ReadyCash by Bank Alfalah menu.