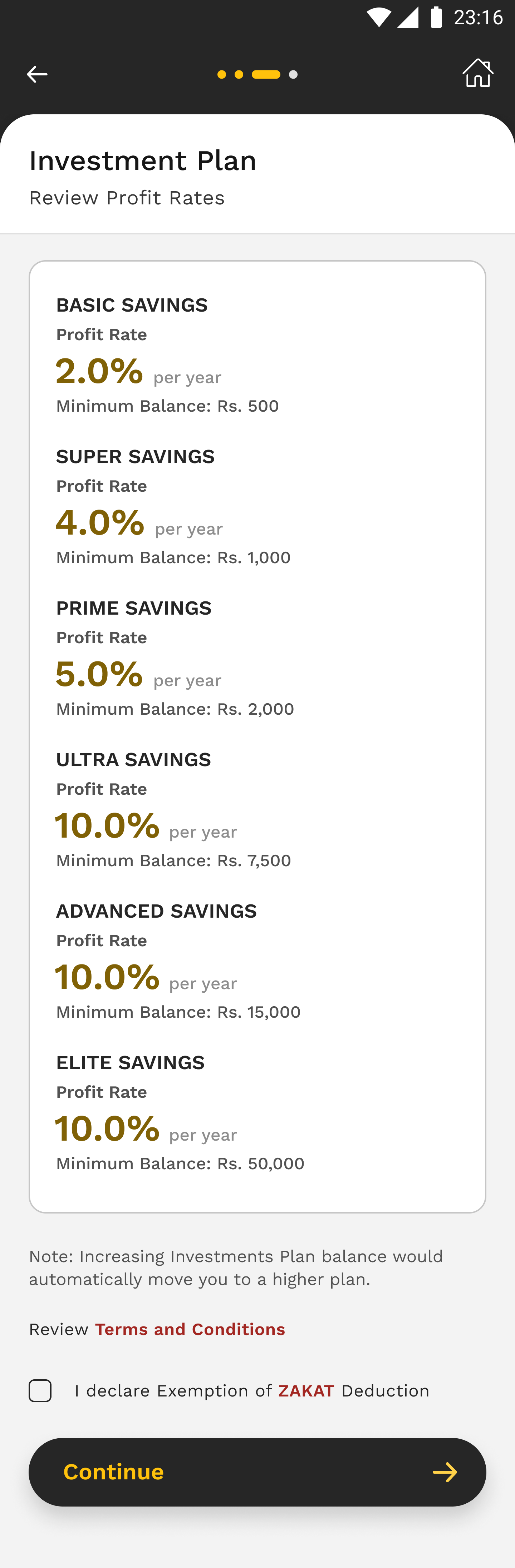

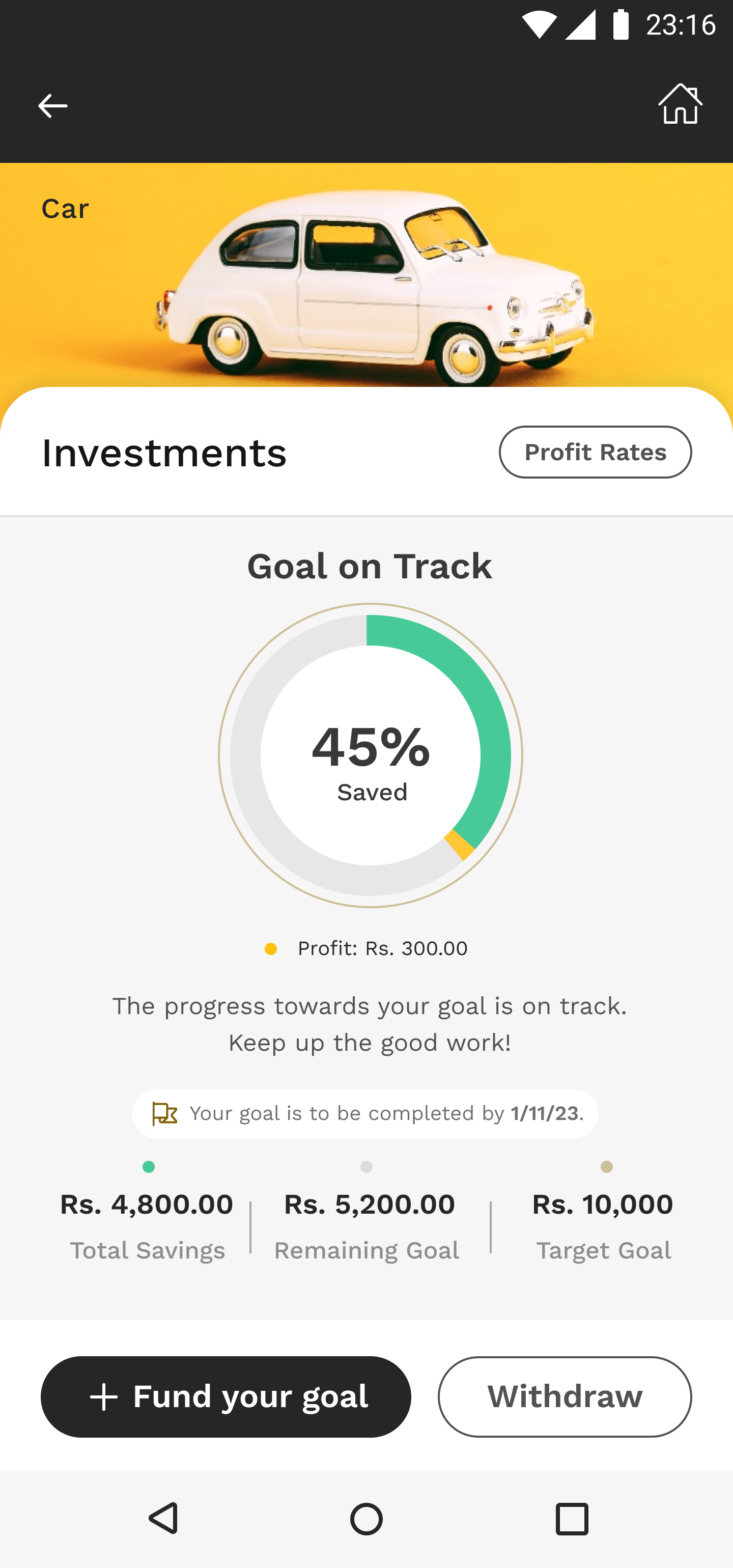

Experience a revolutionary opportunity with Salaam Investments: Islamic investments & Protection Plan designed to align with your financial goals, offering profit rates of up to 10%.

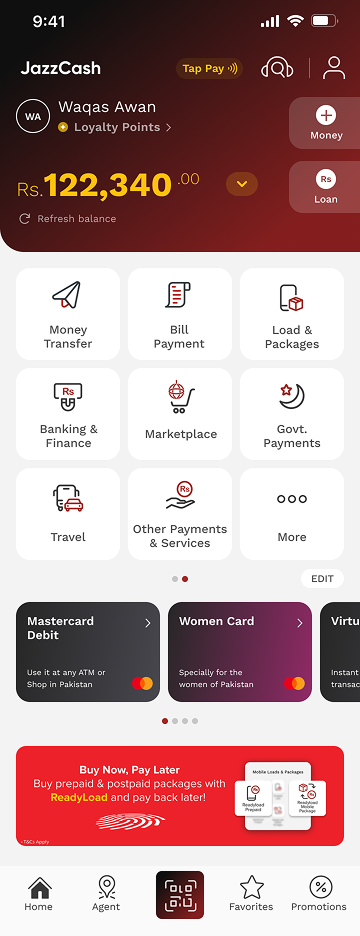

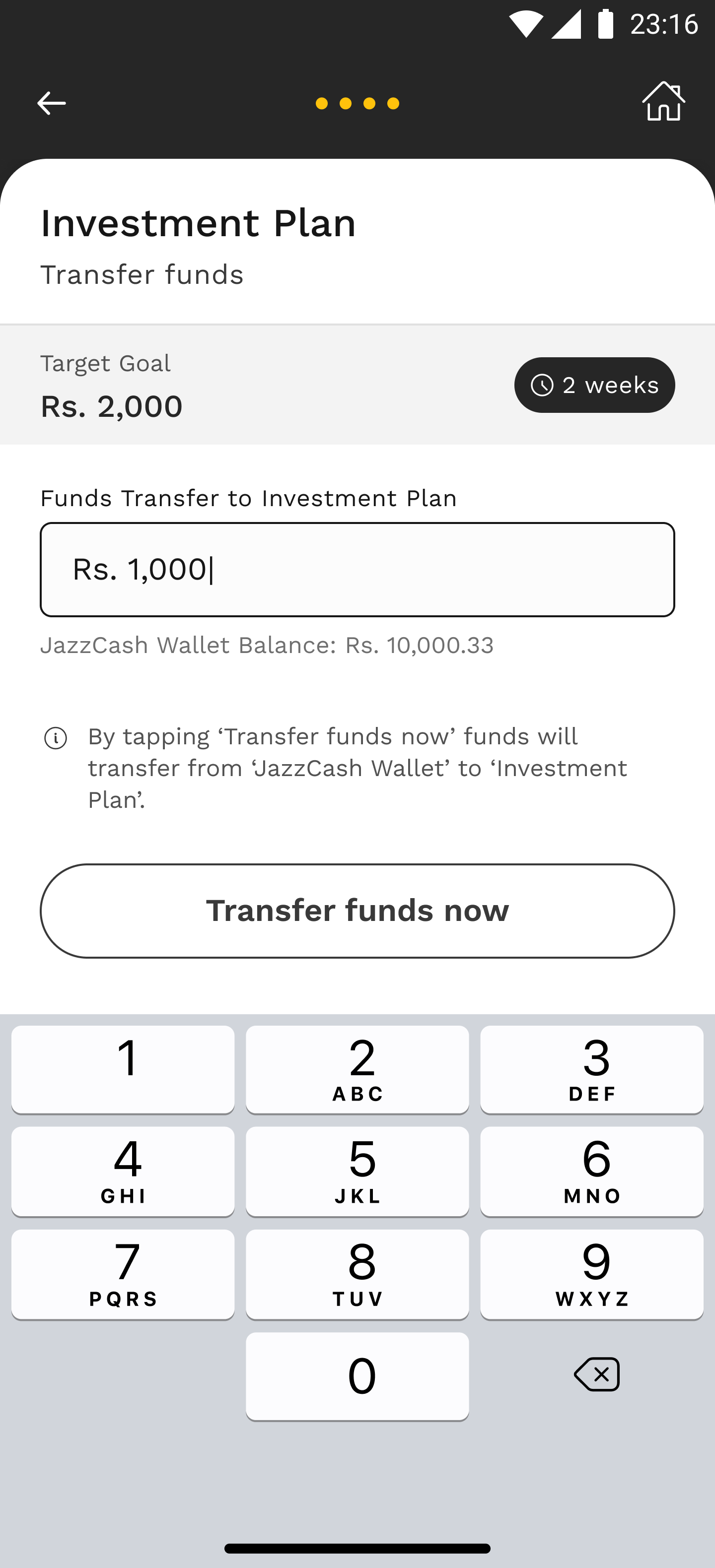

Don’t wait—download the JazzCash app today to enjoy free investment with real-time goal tracking and the chance to earn halal profits daily.

Profit rates being offered:

| Investment Plans | Min Balance | Annual Profit Rate |

| Basic | 500 | 2.00% |

| Super | 1,000 | 4.00% |

| Prime | 2,000 | 5.00% |

| Ultra | 7,500 | 6.00% |

| Advanced | 15,000 | 7.00% |

| Elite | 50,000 | 8.50% |